How U.S. Enterprises Rethink Growth Planning with GCCs

22 October, 2025

Executive Summary

There has been a noticeable shift in how enterprises measure and enact growth within their organizations. A few decades ago, the success of a global enterprise, or a reputable brand was more contingent upon the merger and acquisition (M&A) model and rented intelligence from consultancies; melding capabilities to build a diverse service portfolio or acquiring new infrastructure to maximize geographical growth. Within the past two decades, enterprises have come to realize that the yardstick for growth is limited; measuring and validating high rises, multinational expansions, piled consultancy-led research as success factors instead of internal capability scaling and inherent knowledge work. Now companies are waking up to the need to build internally, for the world, to sustain and nurture service velocity and product innovation.

This new stride of enterprise reinvention marks the imperative of knowledge work and innovation within the enterprise home ground – with Global Capability and Innovation Centers. To maximize innovative potential and value creation, global companies are eyeing emerging locations like Pakistan as a value-added space, to capitalize on untapped engineering talent and research capabilities. This paper will detail the transitory move from borrowed business intelligence and entrepreneurial mettle to in-house capability building; and illustrate why the next modern enterprise needs to anchor longevity and success on intelligence nodes and knowledge hubs that compound data, talent optimization and enterprise infrastructure to provide value.

Introduction

Through the various stages of enterprise evolution, one great marker of progress has emerged in the past two decades: value creation, and sovereign product innovation, research depth, and talent velocity that can enable it. Once, the global enterprise game was measured by cost efficiency, that prioritized outsourcing processes, scaling labor-intensive workforces, and renting intelligence through consultants. Today, that paradigm has shifted.

Modern enterprises are moving beyond borrowed strategy and transactional execution. To drive organic, sustained innovation, organizations are consolidating their data, research, and intellectual capital through Global Capability Centres (GCCs) and Global Innovation Centres (GICs).

The push to internalize capabilities is more than an operational reform; it’s a redefinition of value. The modern enterprise no longer competes on volume or geography, but on the sovereignty of its intelligence; how it captures, protects, and transforms knowledge into innovation. Organizations are architecting inward, designing their own networks of thinkers, builders, and data custodians who generate value from within. Engineering intelligence replaces rented insight, and problem-framing talent drives business outcomes.

The Global Shift in Enterprise Reinvention

In the collective memory of the business world, companies have forgotten more pilot projects than they have sustained. Each year, that wasteland of ideas grows, and reflect the problem as a failure of continuity rather than creativity. Too many projects are built on borrowed intelligence; data and frameworks detached from the organizations that pilot them.

When innovation depends on rented insight, problem-framing is never fully aligned with enterprise reality. Without intrinsic context or sovereign data, ideas lose precision and endurance long before they reach the market. True innovation doesn’t end with ideation, its success depends on the organization’s ability to anchor experimentation in its own intelligence networks, guiding ideas through analysis, testing, and long-term integration.

This is where modern Global Capability Centers (GCCs) are rewriting the rules. They transform innovation from a one-off experiment into a self-sustaining process, where ideas evolve within living systems of data, design, and decision-making. In these environments, every project becomes part of an ongoing conversation between global intelligence and local execution.

North American markets may have long set the tone for global innovation, but the next wave of growth will be defined by how enterprises learn, not how far they can expand. Cost is in the rear-view mirror, and engineering velocity, solution-driven workforces, and rich knowledge repositories of the South are emerging as the new competitive frontier.

What’s unfolding now is a shift in mindset, from buying output to cultivating intelligence through distributed capabilities, across continents and cultures to embody a muscle memory for innovation.

The Descent of Consultant-led Insights and Borrowed Capabilities

Historically, large MNCs have relied on consultancy-led research to drive business intelligence. Cost was the imperative for outsourcing talent and expanding the enterprise footprint; but while that approach resembled innovation and growth, it eventually led to companies short-changing convenience and efficiency for agility and inherent knowledge capacity.

Traditional outsourcing, tied to back-office functionality and staff augmentation is witnessing its descent. Despite the staggering 87% of executives demanding AI-driven capabilities to be part of their third-party vendor services, less than half of them have witnessed discernible productivity gains, and a meagre 25% have witnessed vendor cost reductions.

This resulted in almost 67%, and growing, number of organizations to adopt outcome-based services, pivoting outsourced capabilities towards sales, R&D and marketing for higher value-creation. While outsourcing remains on-course for company leaders, the goalposts are changing for which aspect of enterprise growth it will influence – bringing about the rise of multidimensional sourcing (Karan Aneja et al. 2024).

The decision to prioritizing capability-building over renting intelligence has exposed the cracks in the facade of consultant/enterprise partnership; if organizations want to own

their future; intrinsic knowledge ecosystems will lead the way to it, where until now they have been consumers, not owners of those knowledge pools.

Consultant led research compounded broadly applicable knowledge, distilled to accommodate research needs for each client company, yet left gaps in the key information pertinent to specific business logic and internal operations that could drive innovation. At the turn of every quarter, enterprises looked towards their consulting partners to validate exorbitant research budgets and low value creation, and in some cases defend short-sighted initiatives when the shoe dropped.

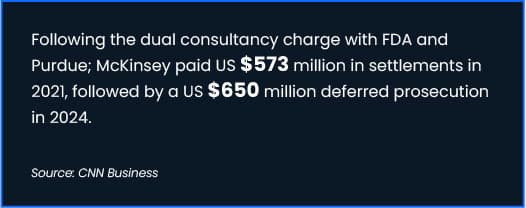

The McKinsey-Purdue case around OxyContin regulations is a stark example of the risk of renting intelligence. Over more than a decade, McKinsey advised Purdue to ‘turbocharge’ opioid sales; targeting high-prescribing doctors, refining promotional messaging, and urging market expansion even as addiction rates rose (CNN Business and Sgueglia 2021). Internal conversations about destroying evidence under regulatory pressure signal exactly how external strategy can detach from internal accountability, and create an irreversible erosion of trust, regulatory scrutiny, and reputational damage.

The various instances of risks arising from outsourcing intelligence as well as core capabilities make a double-fold case for preserving and honing talent and innovation loops internally.

Imagine outsourcing not just tasks, but the core of enterprise capability; its engineering specification, safety-critical design and institutional continuity. That’s what Boeing did with the 737 MAX. Parts of software development and testing were assigned to subcontractors offshore, some paid as little as US$9/hour, many without deep aerospace domain-expertise (IndustryWeek 2019).

When those contractors made errors; mis-drilled holes, weak component design, fractured documentation, and testing oversights, the QA burden fell back on Boeing’s internal teams. But by then, much of the tribal knowledge had been lost; senior engineers were laid off, long-serving technicians retired, and some were replaced by

less experienced contractors. This was a strategic collapse of intellectual sovereignty. Boeing incurred massive financial losses, and experienced grounded fleets, cancelled orders as well as regulatory distrust (Forbes and Banker 2024).

These two cases are vital lessons in the importance of critical internal R&D, and core capabilities, because third-party reliance diffuses responsibility, delays feedback loops and skews decision-making frameworks that benefit contractors and consultancies more than the enterprise itself.

New Growth Horizons Through Multi-Sourcing Capabilities

Enterprises have a growing interest in owning and scaling their business intelligence, raising a question for the potency of research partnerships. In addition to accumulating technical and knowledge debt, consultancy-led strategy keeps decision-makers rooted in a one-roadmap-fits-all vacuum, unable to chart growth towards specific business goals. One the flip side, organizations that prioritize internal capability-building, experience less risky, but prominent roadblocks in innovation and product development. What’s the middle ground for evolving enterprises navigating growth and innovation capacity?

The answer is a two-pronged approach;

1) amalgamating core capabilities within the organization, like R&D, frontier tech and analytics to enrich data and knowledge nodes within the enterprise, (picture a team of researchers, pharmaceutical experts and AI engineers conducting tests and simulations to detect anomalous tumors).

2) cherry-picking elite talent and change-drivers from external avenues, rather than acquiring entire businesses to absorb their capabilities. This ensures enterprise resilience, with minimal risk and effect on business outcomes. There are two stand-out examples in the industry to illustrate this approach.

Consider the recent move by Meta; in the ongoing rush to acquire and retain elite AI talent, the company not only invested almost $15 billion for a considerable 49% stake in Scale AI, but also onboarded its CEO, Alexandr Wang, to fuel innovation for the new AI data center (Nasdaq 2025). Competitors in the field have followed suite to prevent high attrition, with Open AI and Google DeepMind gunning for the top AI talent, offering exorbitant salaries and benefits to secure experts that are few and far in between. This standoff is not a brand war, but a pre-emptive effort to accumulate and nurture expertise in frontier technology, to rapidly innovate without compromising productivity, agility and knowledge ownership.

A decisive departure from traditional mergers and acquisitions, where companies once bought infrastructure, patents, or market share; Meta established human capital as the most valuable acquisition, to ensure that innovation is not inherited but organically generated, scalable and entuned to enterprise needs.

The bid to secure enterprise resilience is neatly illustrated by Google’s move to reorganize its AI research ecosystem in 2024, when it merged DeepMind with Google Brain into a unified, product-focused division. Originally positioned as a pure research lab, DeepMind’s integration into Google’s broader AI infrastructure marked a shift from isolated experimentation to an embedded model of in-house innovation sovereignty. By

uniting research and product teams under one structure, Google effectively created a self-contained knowledge hub capable of developing proprietary technologies, safeguarding intellectual property, and reducing reliance on external researches to maximize value-added development through internal centers of excellence, directly aligned with business outcomes and long-term technological leadership (Julia Love and Mark Bergen 2024).

The strategic imperative of Google and Meta’s acqui-hire and internal knowledge convergence initiatives have now illuminated a pathway for enterprises to establish outcome-driven global capability and innovation centers that reinvent with autonomy

" Future-focused enterprises can curate organizational structures, by galvanizing AI-enabled talent and sovereign data hubs to become change-drivers for innovation; and mature key functionalities, achieve faster deployments and reorient resources to move up the value chain."

The Balancing Act of Building Internal Knowledge Capacity

As companies race to secure the top hand in market dominance; the key to sustainably innovate and scale is ensuring robust data governance. Gartner cites that 80% of organizations will fall short of digital scaling due to poor data and analytics governance (Tony Harris and Thakur 2025), because unifying the source of truth is one part, utilizing it responsibly is the next step. Enterprises recognize the risks of rented intelligence, and lax guardrails, what could be the roadmap to averting it?

Almost three decades ago, Capital One pioneered data analytics and AI innovation into their core business strategy to continuously redefine their business model, treating data as a proprietary asset rather than a byproduct of operations. The company’s enterprise data strategy unifies platforms across business units to establish a single, integrated source of truth. This enables insights from one domain, such as banking, to inform decisions in others, like credit cards, improving personalization and operational efficiency. Additionally, Capital One secured early-mover advantage by training their internal workforce on data-driven methodologies that utilize AI and machine learning. Their investment in analytics has helped achieve double-digit growth in digital adoption and customer engagement over the past decade. By appointing clear data owners and embedding governance across its systems, the company transformed its data centers into engines of collaboration and innovation (Forbes and Bean 2024).

This shift towards centralized, well-governed data hubs aimed at enhancing competitiveness, compliance, and decision intelligence, are the bedrock of Global Capability Center (GCC) frameworks. Industry veterans like Capital One integrated automation and digitalization into their core strategies early on, setting the stage for a GCC-like structure that could evolve with business needs. And yet reliance on external vendors has remained the norm across sectors.

Challenges persist for companies juggling service delivery across diverse markets and ensuring value creation through internal knowledge capacity. In cases where complete data ownership poses risk, enterprise growth is augmented by hybrid systems.

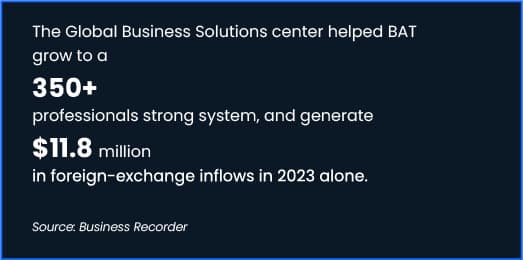

British American Tobacco’s (BAT) journey illustrates a hybrid GCC model; one that began with captive strength and evolved through strategic external collaboration as scale and complexity grew. In 2021, BAT invested $5 million to establish its Global Business Solutions hub in Lahore, serving over 50 countries across finance, marketing, supply chain, data analytics, and insights functions. This hub became the foundation for embedding internal expertise across core business functions, creating localized value chains governed by institutional knowledge (Business Recorder 2024).

Initially a fully captive setup, BAT retained full control over infrastructure and decision-making. But in 2025, the company partnered with Accenture to transform its GBS and Supply Network Operations, integrating AI, analytics, and process simplification for global agility (Reuters 2025). Around the same time, SAA Services, BAT’s internal IT and shared services arm, was acquired by Systems Limited, which now manages these operations externally while remaining under BAT’s strategic oversight (Business Recorder 2025). Together, these moves mark BAT’s shift toward a hybrid model combining internal knowledge ownership with external augmentation to accelerate innovation and operational resilience.

The GCC Evolution – A Case of Innovation in AgriScience

The next natural progression in this spectrum is what we see in global agriscience enterprises; Monsanto, Bayer, and Corteva. These organizations moved from vendor-supported ecosystems to distributed, innovation-driven GCC models.

Monsanto: The Precursors of Captive Knowledge

Monsanto’s early forays into biotech R&D predate the GCC vocabulary but embody its foundation. Across local and global field stations, Monsanto built a vertically integrated research framework by retaining intellectual property, genetic data, and core R&D in-house while collaborating externally with universities and biotech startups. Monsanto’s hybrid ecosystem was the prelude to the captive GCC logic; protect what you invent, even if the testing happens elsewhere.

This structure proved fruitful with nearly 4,000 field trials across the U.S. Midwest, as Monsanto’s Genuity SmartStax hybrids outperformed older triple-stack hybrids by roughly 4 bushels per acre in key maturity bands proof that proprietary, internal R&D pipelines generated tangible productivity gains (PR NewsWire 2010).

Similarly, its BioAg Alliance with Novozymes demonstrated the compounding benefits of in-house control over trial design and microbial strain innovation, achieving average yield increases of 4 bushels per acre for corn and 2 for soybeans (Jacobs 2015). These advances were made possible precisely because of the company-controlled data, field testing, and genetic platforms, rather than the reliance on rented capabilities.

In the bell-curve of enterprise maturity, Monsanto represents the mid-early GCC model, a centralized innovator supported by external partnerships; the precursor to today’s distributed, self-sufficient innovation hubs.

Bayer Crop Science: The Consolidation of Capabilities

Following the Monsanto acquisition, Bayer evolved the model further. The company consolidated global R&D centers across Europe, the U.S., and Asia-Pacific, creating interconnected nodes for crop science, analytics, and biotechnology. Unlike Monsanto, Bayer’s structure enabled regional autonomy as labs and breeding centers on different continents began driving local product innovation rather than just executing headquarters’ directives. Governance remains centralized, but autonomy in data-driven decision-making is expanding, allowing regional data hubs to feed knowledge into the single source of truth, and echoing the design of innovation-led GCCs (Bayer Global 2019). This internal integration has paid off. By 2024, Bayer’s Crop Science division reported that its AI-assisted R&D processes were identifying three times as many new herbicide modes of action compared to a decade prior; a pace only possible through in-house computational biology and data analytics teams (Bayer Global 2021). The company also maintains one of the world’s largest internal research networks, with over 16,800

scientists and researchers, underscoring that the retention of institutional knowledge directly correlates with sustained innovation (Evogene 2016). Bayer sits at the midpoint between captive GCCs and innovation-driven GCCs; balancing sovereignty with open innovation and global partnerships.

Corteva Agriscience: The Full Maturity of the GCC Model Bell Curve

Corteva represents the culmination of the GCC evolution. It is a company that operates through fully captive, end-to-end innovation nodes across geographies. By establishing regional centers from Texas to Germany (József Máté 2023); it now functions as a self-contained GCC, integrating labs, analytics, and field operations under unified governance. These hubs not only develop proprietary technology but also generate, test, and commercialize innovation locally, within a shared global framework.

Corteva’s internal R&D strategy has directly translated into measurable business and sustainability outcomes. The company’s $27.5 million R&D lab in Midland, Michigan embodies a unified innovation architecture; merging analytical, chemistry, and engineering capabilities to accelerate commercialization cycles (Milne 2025). A 2024 MDPI efficiency study ranks Corteva among the few global seed firms with both technological advancement (TECHCH > 1.03) and operational efficiency; showing that innovation is not only being created but effectively absorbed into production (MDPI Open Access Journals et al. 2025). By eliminating reliance on external intermediaries, Corteva embodies the GCC promise; innovation that is sovereign, scalable, and securely held within the enterprise’s value chain. Its Q1 2025 results showed margin expansion and cost reductions despite market volatility, credited to the strength of its “next-generation technology pipeline” (Corteva 2025).

New Soil for Innovation: Pakistan as the Next GCC Horizon

If Corteva represents the culmination of a mature GCC ecosystem; one where sovereignty over research, data, and innovation forms the core of enterprise growth, then the next frontier lies in how regional capability nodes strengthen that global intelligence fabric. The distributed modern GCC model is about developing geographic intelligence; creating knowledge centers that absorb, refine, and re-route insights back into the enterprise’s single source of truth. This evolution in the business sphere has seen South Asia emerge as one of the most fertile regions for enterprise capability building, and among its contenders, Pakistan presents a particularly strategic advantage.

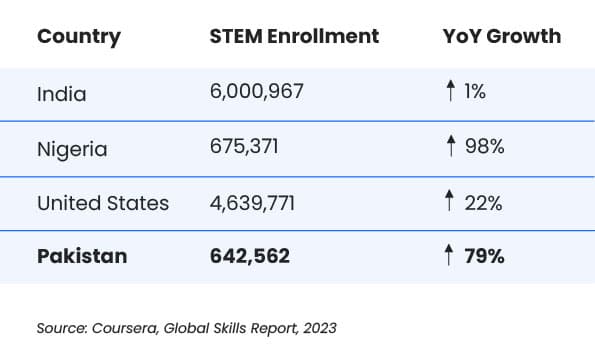

Traditionally known as a major exporter of semi-skilled labor, Pakistan’s trajectory has shifted dramatically in the past two decades. The country’s evolution toward a knowledge-centered digital economy has been slow but deliberate. As the future of global business commands AI-literacy as a core factor of its workforce, Pakistan rises as a worthy contender, ranked 4th globally in AI skill development (Schwartz Reisman Institute for Technology and Society 2024). With most organizations choosing to internalize their capabilities, a great signifier for forward-focused enterprises will be matured R&D pipelines forged through inherent knowledge work that facilitates innovation and experimentation. As of 2023, Pakistan is becoming a burgeoning space for research-based learning, with 642,562 STEM enrolments, and a staggering 79% year-over-year growth. For organizations that are developing research capabilities to support their next decade of invention, innovation and experimentation; Pakistan provides a rich source of knowledge workers that can architect the pillars that can support sustained value creation (Coursera and Khullar 2023).

The country has cultivated a thriving domestic IT ecosystem, driven by homegrown innovation hubs like the National Incubation Centers (NICs), and local startups now on the radar of global investors such as Endeavor and other venture networks (Griletti 2022).

As previously illustrated, the firm-footing of multinationals like British American Tobacco and the partnerships with powerhouses such as Systems Limited and NetSol Technologies have enabled foreign companies to mark their global footprints here. European technology firms, such as IceWarp, have announced partnerships to

establish data centers in Pakistan signaling confidence in the country’s digital literacy, infrastructure reliability, and cost-to-capability ratio (MOIB - GOP 2024).

On the institutional front, the government backs AI growth through programs like the Presidential Initiative for Artificial Intelligence and Computing (PIAIC) aimed at boosting education, research, and business in AI, blockchain, and cloud technologies (GOP - Government of Pakistan 2018). In academic and policy circles, there’s recognition of Pakistan’s latent potential: research on its AI sector frames the country as a candidate to shift from service-oriented roles to becoming an indigenous innovator in AI infrastructure and product development (Cornell University, Hussain, et al. 2024).

At a time when Western economies face an acute talent drought, especially in AI engineering and data science, Pakistan represents a reservoir of domain-trained, frontier-ready professionals who can anchor global enterprises’ shift from outsourced efficiency to insourced intelligence. As AI automates execution-centric workflows, the competitive edge for enterprises will hinge upon knowledge creation, research depth, and cultural adaptability. This is where Pakistan’s unique blend of technical skill, entrepreneurial energy, and adaptive mindset becomes transformative. It offers enterprises not just efficiency, but resilience and sustained value creation; enabling them to build knowledge-first GCCs that are self-learning, data-sovereign, and innovation-driven.

In the new GCC paradigm, Pakistan is the essential piece that completes the regional architecture of knowledge; the tether between South Asia’s deep talent reservoirs and the global enterprise’s need for knowledge sovereignty. Its strength lies in its potential to weave a tight lattice of innovation with knowledge economies of South and East Asia; a strengthened corridor of enterprise intelligence running through Pakistan, India, and China, connecting markets and minds, allowing knowledge to move where it can be best cultivated. What emerges, then, is not merely another outsourcing hub, but new soil for enterprise intelligence.

Conclusion

Sovereign Intelligence: Defining the Next Decade of Enterprise Innovation

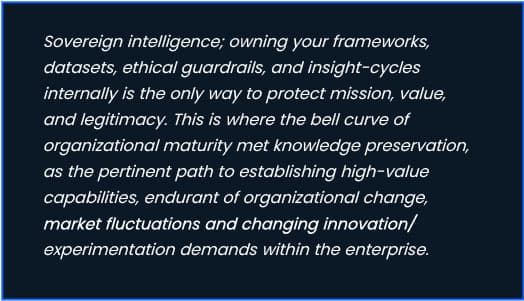

Across industries, a quiet transformation is underway. As global companies race to secure their longevity, the question has shifted from “Where can we outsource more?” to “What can we truly own?”.

Organizations have struggled with maintaining their innovation pipelines and are now slowly recognizing that knowledge has been a borrowed structure; coming down like a house of cards when rented intelligence exists with the vendors. The next wave of enterprise leadership will be defined by sovereign intelligence; the ability of organizations to understand, own, and evolve their knowledge ecosystems with intent, preserving solid, foundational data to build upon and sustain innovation. As AI and frontier technologies reshape how productivity and value are created, growth is no longer a measure of expansion; it reflects how intelligently a company can translate its internal strengths into lasting impact.

The question guiding enterprise growth has shifted from outsourcing and cost efficiency toward knowledge ownership and capability depth. Companies need to command their own data pipelines, research cycles, and innovation systems to sustain advantage in a volatile global landscape, where business intelligence functions as the central nervous system of reinvention.

It helps enterprises see themselves clearly; mapping where their value originates, how it multiplies, and where it needs to evolve next. When data, knowledge, and human insight operate as a shared ecosystem, decision-making is horizontal, autonomous, and adaptive.

Modern GCCs embody this transformation. They allow organizations to anchor nodes of intelligence within regional strongholds; decentralized yet connected structures that consolidate insights into a single, unified source of truth. Within these hubs, experimentation becomes continuous, and data moves from passive reporting to active problem-solving. Each GCC becomes a self-learning system, guided by forward-focused engineers; individuals whose curiosity, technical precision, and vision drive the company’s mission ahead.

The rapid evolution of AI has accelerated the enterprise maturity curve, compressing decades of transformation into a few short years. Companies that integrate artificial and human intelligence are finding a new rhythm of growth; moving from scaling operations to deepening business intelligence. Organizations that build on this foundation will extend their value creation, retain strategic autonomy, and endure as knowledge-first enterprises in a world propelled by reinvention.

Bibliography

- Bayer Global. 2019. “R&D Pipeline: Toward Tailored Solutions for Farmers Around the World.”

- Bayer Global. 2021. “Bayer’s Unmatched R&D Investment Powers Industry-Leading Crop Science Portfolio.” Bayer Global , March 12.

- Business Recorder. 2024. BAT Launches Global Business Solutions Hub in Lahore. May 19. https://www.brecorder.com/news/40303650/bat-launches-global-business-solutions-hub-in-lahore

- Business Recorder. 2025. BAT’s Arm Acquired, Accenture Now a Partner: SYS Expands Global BPO Reach. July 30. https://mettisglobal.news/Systems-acquires-BATs-IT-arm-secures-Accenture-contract-54111.

- CNN Business, and Kristina Sgueglia. 2021. “McKinsey to Pay Nearly $600 Million in Settlements over Its Work with Opioid Companies.” CNN Business, February 4. https://edition.cnn.com/2021/02/04/business/mckinsey-opioid-settlement/index.html

- Corteva. 2025. “Corteva Delivers Strong 1Q 2025, Reaffirms 2025 Outlook.” Corteva, May 7. https://investors.corteva.com/news-releases/news-release-details/corteva-delivers-strong-1q-2025-reaffirms-2025-outlook.

- Coursera, and Lochan Khullar. 2023. Global Skills Report .

- Evogene. 2016. “Evogene Discloses Positive Results in Yield Improvement Collaboration with Monsanto Utilizing Novel ‘Trait-First’ Methodology.” Evogene BioTech, February 16. https://evogene.com/press_release/evogene-discloses-positive-results-yield-improvement-collaboration-monsanto-utilizing-novel-trait-first-methodology/

- Forbes, and Steven Banker. 2024. Boeing Is Haunted By Two Decades Of Outsourcing. February 12. https://www.forbes.com/sites/stevebanker/2024/02/12/boeing-is-haunted-by-two-decades-of-outsourcing/

- Forbes, and Randy Bean. 2024. “Capital One: The Ongoing Story Of How One Firm Has Been Pioneering Data, Analytics, & AI Innovation For Over Three Decades.” Forbes, August 12. https://www.forbes.com/sites/randybean/2024/08/11/capital-one-the-ongoing-story-of-how-one-firm-has-been-pioneering-data-analytics--ai-innovation-for-over-three-decades/

- GOP - Government of Pakistan. 2018. “Presidential Initiative for Artificial Intelligence and Computing PIAIC.” https://www.piaic.org/.

- Griletti, Lais. 2022. “Endeavor Launches Its 40th Office in Pakistan, Providing a Global Support System for High-Growth Pakistani Founders.” Endeavour, May 16. https://endeavor.org/stories/endeavor-launches-its-40th-office-in-pakistan-providing-a-global-support-system-for-high-growth-pakistani-founders/?utm_source=chatgpt.com.

- Cornell University, Atif Hussain, and Rana Rizwan. 2024. The Case for an Industrial Policy Approach to AI Sector of Pakistan for Growth and Autonomy. https://arxiv.org/abs/2411.01337

- IndustryWeek. 2019. “Boeing’s 737 Max Software Outsourced to $9-an-Hour Engineers.” June 29. https://www.industryweek.com/supply-chain/article/22027840/boeings-737-max-software-outsourced-to-9-an-hour-engineers

- Jacobs, Dan. 2015. “Monsanto, Novozymes BioAg Alliance Field Trial Shows Promise.” AgriBusiness Global.

- József Máté. 2023. “Corteva Opens First Regional Integrated R&D Center in Eschbach, Germany.” Corteva Agriscience, June 21. https://www.corteva.com/resources/media-center/corteva-opens-first-regional-integrated-r-d-center-in-eschbach-germany.html

- Julia Love, and Mark Bergen. 2024. “Google DeepMind Shifts From Research Lab to AI Product Factory.” Bloomberg, June 17. https://www.bloomberg.com/news/articles/2024-06-17/google-deepmind-shifts-from-research-lab-to-ai-product-factory

- Karan Aneja, Juan Coronado, and Mike Stoler. 2024. Multidimensional Sourcing: Orchestrating the Extended Workforce Ecosystem.

- MDPI Open Access Journals, Nan Wang, Yunning Ma, and Yongrock Choi. 2025. “Efficiency Evaluation of the World’s Top Ten Seed Companies: Static and Dynamic Analysis in the Context of Global Consolidation and Sustainability Challenges.” MDPI, April 9.

- Milne, Max. 2025. “Corteva Breaks Ground on $27.5M R&D Lab in Midland.” Midland Daily News (Midland), September 9. https://www.ourmidland.com/news/article/corteva-breaks-ground-27-5m-r-d-lab-midland-21038601.php

- MOIB - GOP. 2024. “European Companies Show Interest in Investing in Pakistan’s IT Sector.” Ministry of Information and Broadcasting - Government of Pakistan, May 4.

- Nasdaq. 2025. “Why Is Meta Fueling the Frenzy for AI Talent and Acqui-Hires.” Nasdaq, June 15. https://www.nasdaq.com/articles/why-meta-fueling-frenzy-ai-talent-and-acqui-hires

- PR NewsWire. 2010. “Field Trial Results in Key Relative Maturities Exhibiting Yield Advantages of Monsanto Genuity® SmartStax® Corn Hybrids.”

- Reuters. 2025. British American Tobacco Announces Global Partnership With Accenture. July 30. https://www.tradingview.com/news/reuters.com%2C2025%3Anewsml_FWN3TR17Z%3A0-british-american-tobacco-announces-global-partnership-with-accenture/

- Schwartz Reisman Institute for Technology and Society. 2024. Global Public Opinion on Artificial Intelligence (GPO-AI). https://srinstitute.utoronto.ca/public-opinion-ai

- Tony Harris, and Panchalee Thakur. 2025. “Global Capability Centers as Data Hubs: Building a Foundation for Advanced Analytics and AI.” Tony Harris, September 3. https://www.torryharris.com/insights/articles/global-capability-centers-as-data-hubs?utm_source=chatgpt.com.