How Web 3.0 and Blockchain are Transforming FinTech?

24 September, 2024

Web 3.0, the next evolution of the internet, shifts power from centralized platforms to users. It’s decentralized, driven by AI, and built to give individuals control over their data, creating a more secure, interactive, and user-driven online experience.

At the heart of this revolution is blockchain, a decentralized technology that ensures transparency, security, and immutability. By enabling peer-to-peer transactions and smart contracts without intermediaries, blockchain drives the decentralized economy and disrupts traditional financial systems.

With the blockchain market set to hit $39.7 billion this year, its transformative impact is undeniable. From decentralized finance (DeFi) to user-owned data, Web 3.0, powered by blockchain, is poised to reshape industries, especially fintech, by making systems more secure, efficient, and transparent.

Understanding Web 3.0 and Blockchain

Web 3.0, the decentralized web, breaks away from the centralized control of previous versions. While Web 1.0 was static and Web 2.0 allowed for interaction but at the cost of data centralization, Web 3.0 gives users control over their data through blockchain. It enables peer-to-peer networks, providing more security, privacy, and ownership. This shift toward decentralization creates a more user-driven, transparent internet where individuals own their digital assets.

Emerging technologies like DeFi (Uniswap, Aave) are reshaping financial services by enabling peer-to-peer transactions without intermediaries, while NFTs (OpenSea, Rarible) allow creators to tokenize and sell digital assets. Smart contracts on Ethereum automate secure transactions, and DAOs (MakerDAO) decentralize decision-making.

Cross-chain protocols likePolkadotand Cosmos further enhance blockchain interoperability, driving collaboration. These innovations showcase how Web 3.0 is transforming industries with decentralized, secure solutions.

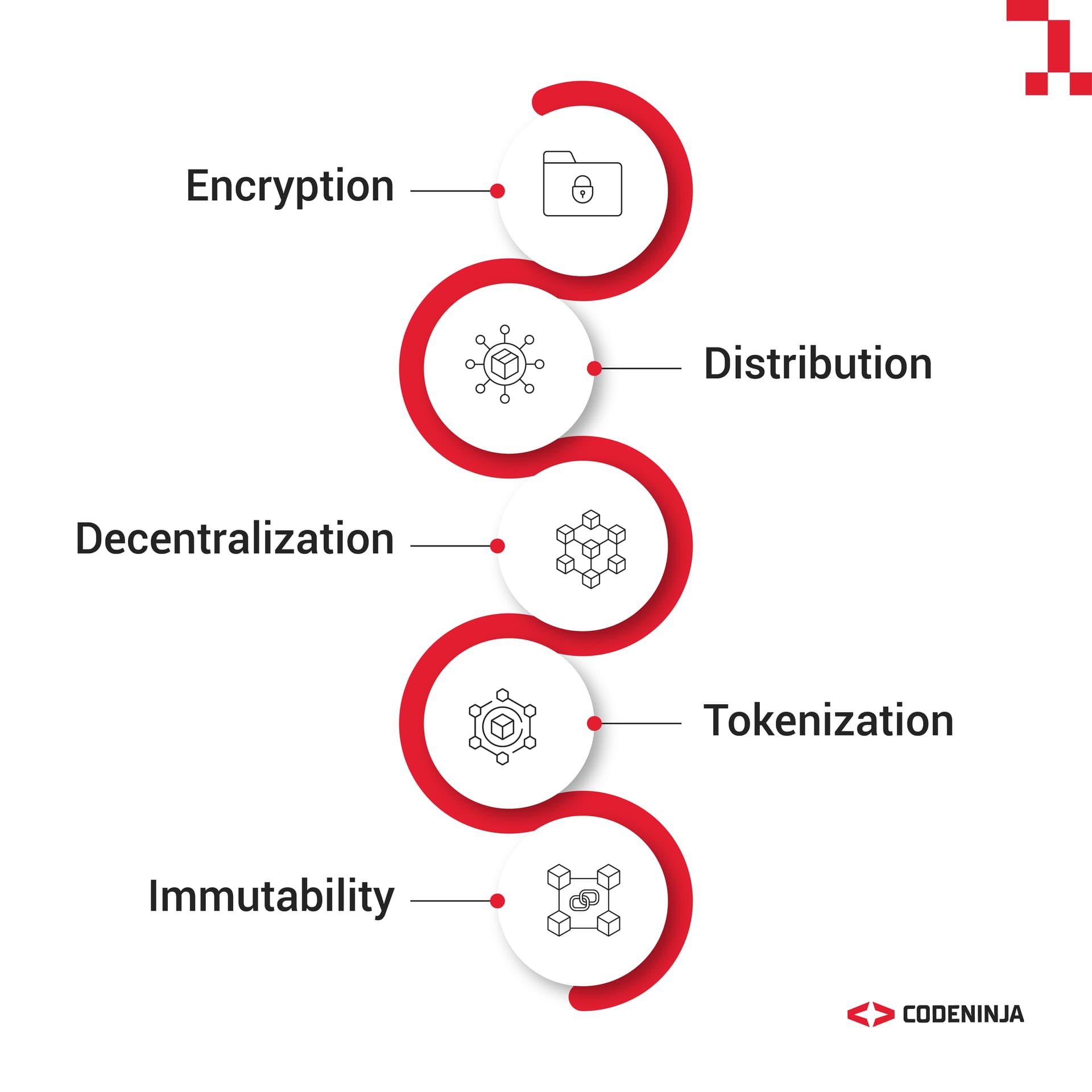

Key Features of Blockchain

Blockchain technology is anchored by three defining features: decentralization, immutability, and transparency. These core attributes form the foundation of its strength and transformative potential.

- Decentralization ensures that control and data are distributed across a network, preventing any single entity from monopolizing it. This structure enhances security by eliminating central points of failure and relies on consensus mechanisms (e.g., Proof of Work, Proof of Stake) to validate transactions collectively.

- Immutability guarantees that once data is recorded on the blockchain, it cannot be altered without network consensus. This creates a permanent, tamper-proof record, significantly reducing fraud risks.

- Transparency allows all participants in the network to view transactions openly, fostering trust and accountability by ensuring all actions are verifiable and traceable.

These core features of blockchain form the foundation of Web 3.0, creating a seamless synergy for a decentralized, user-controlled internet. Blockchain powers Web 3.0 through secure, trustless transactions, smart contract automation, and token economies, shifting control from centralized platforms to users and fulfilling the vision of a more open, autonomous digital ecosystem.

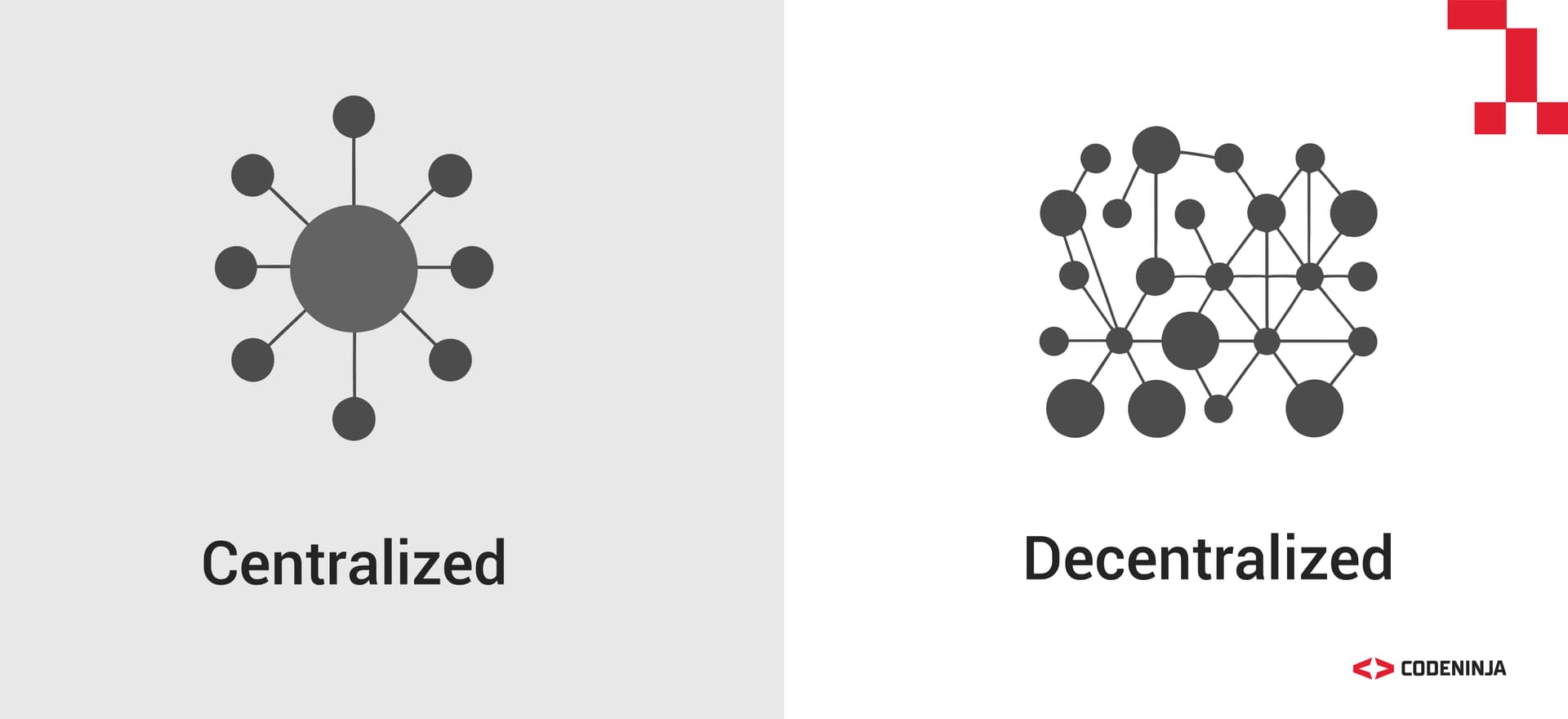

This synergy between Web 3.0 and blockchain sparks a key debate: decentralized vs. centralized systems. Decentralization empowers users with control and transparency, while centralization offers efficiency. The real question is—which model will define the future of digital infrastructure?

Decentralized vs. Centralized Systems

Centralized systems are built around a single authority that manages data and operations, enabling streamlined decision-making and control. Traditional banking, social media platforms, and cloud services are prime examples.

In contrast, decentralized systems, like those enabled by blockchain in Web 3.0, distribute control across multiple participants, fostering direct user interaction without intermediaries. This shift enhances security, autonomy, and transparency, seen in applications like cryptocurrencies, DeFi, and peer-to-peer networks.

Trade-offs Between Centralized and Decentralized Systems

With the digital transformation market projected to reach $3.3 trillion by 2025, the debate between centralized and decentralized systems is critical in shaping the future of digital infrastructure. Both models offer unique advantages and challenges for businesses in this evolving landscape.

Centralized systems, with their efficiency, scalability, and streamlined management, continue to dominate many industries. Enterprises in banking, healthcare, and cloud services rely on centralized models for fast, reliable operations and easier compliance with regulations.

However, as data privacy concerns grow, businesses may face increasing pressure from customers who demand greater control over their personal data. The centralization of power also creates vulnerabilities, as any failure or breach in a central system can disrupt entire operations, damaging trust and reputation.

On the other hand, decentralized systems offer a more user-centric approach, empowering individuals with control over their assets and data. In sectors like finance, decentralized finance (DeFi) is challenging traditional banking by providing secure, transparent alternatives.

However, businesses adopting decentralized models must navigate issues of scalability, governance, and regulatory uncertainty. While decentralized systems promote transparency and trust, they also present complex technical challenges that may hinder widespread adoption.

As industries transform, businesses must decide whether to prioritize the efficiency of centralized systems or embrace the transparency and resilience of decentralized models. This debate will play a defining role in the future of digital infrastructure.

Blockchain's Integration in FinTech and DeFi

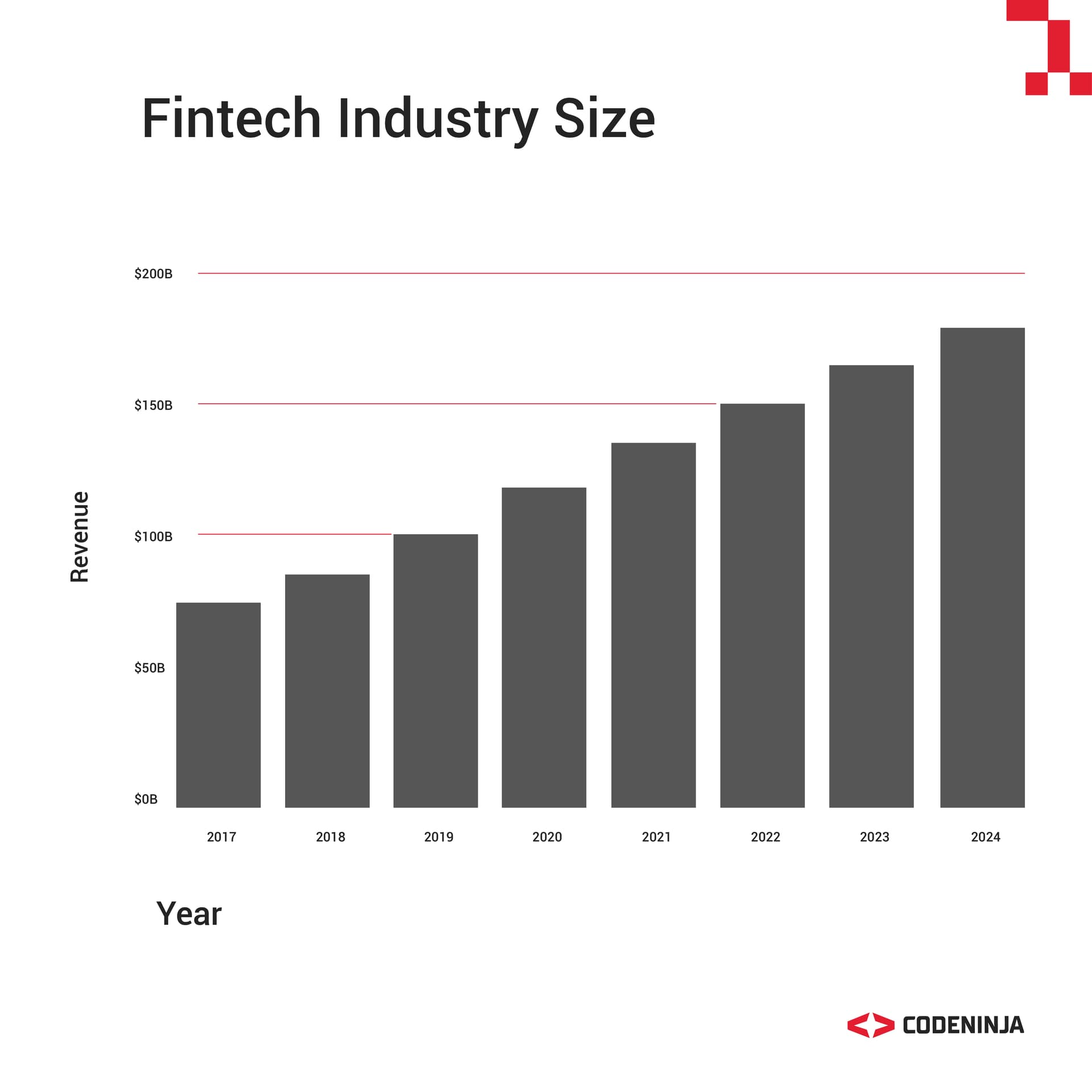

According to Deloitte, global fintech industry revenue has more than doubled since 2017, from $90.5 billion to over $226 billion in 2023. Blockchain is a key driver of this growth, reshaping the fintech landscape by streamlining processes, enhancing security, and reducing costs.

It eliminates payment intermediaries, speeds up cross-border transactions, and digitizes trade finance, reducing fraud and delays. Smart contracts automate settlements in asset management, while tokenization opens new investment opportunities.

Additionally, blockchain strengthens regulatory compliance with transparent, tamper-proof records, fueling the industry's projected growth to $917.17 billion by 2032.

Decentralized Finance (DeFi)

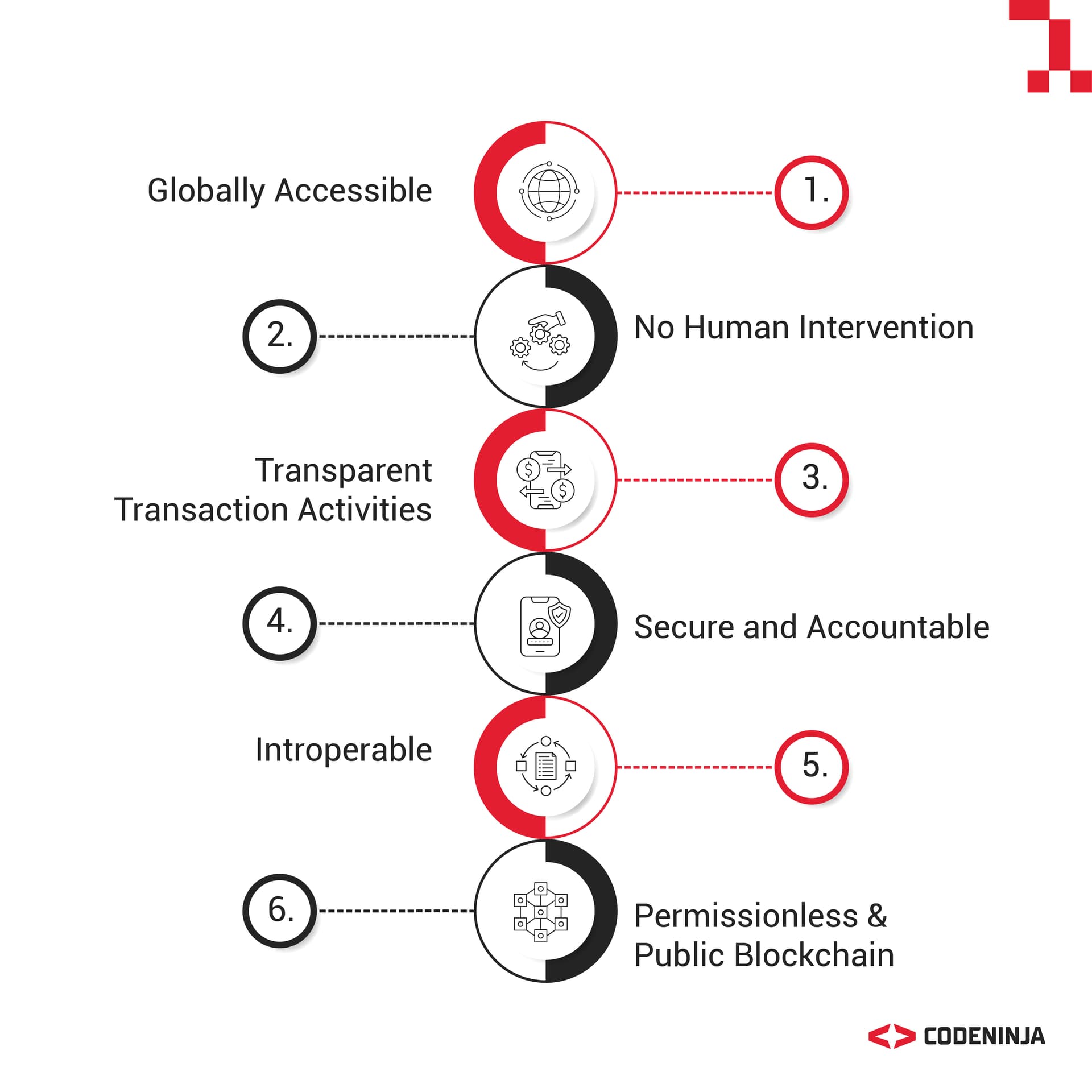

Decentralized Finance (DeFi) harnesses blockchain, particularly Ethereum, to build a peer-to-peer financial network where smart contracts automate transactions without intermediaries. Through decentralized applications (dApps), users can lend, borrow, and trade assets directly.

DeFi offers major advantages over traditional finance, including broader accessibility, lower fees, faster transactions, higher interest rates, and continuous innovation. However, it also faces challenges such as security risks in smart contracts, regulatory uncertainty, user complexity, and market volatility.

Despite these obstacles, DeFi is revolutionizing finance by offering a more transparent, flexible, and inclusive financial system.

The Future of Blockchain in FinTech

The future of blockchain in fintech is poised for significant growth, with the market projected to surge from $2.2 billion in 2022 to $93.3 billion by 2032, driven by digital payments, DeFi, and AI advancements. The adoption of decentralized finance (DeFi), predicted to exceed $398 billion by 2031, transforms financial services by replacing traditional intermediaries with peer-to-peer networks.

Additionally, central banks are exploring Central Bank Digital Currencies (CBDCs) to boost financial inclusion. Innovations in cross-border payments, asset tokenization, and smart contracts will further enhance efficiency and liquidity in financial markets.

However, challenges like regulatory uncertainty, security vulnerabilities, and interoperability issues remain hurdles. As 86% of financial executives expect blockchain to achieve mainstream adoption by 2025 (PwC), regulatory frameworks will play a crucial role in fostering innovation, ensuring security, and protecting consumers in this rapidly evolving space.

Conclusion

Blockchain, powered by Web 3.0, is set to revolutionize the financial landscape through decentralized finance (DeFi) and smart contract automation. Its potential to streamline processes, enhance security, and promote transparency is already transforming industries.

As the fintech sector continues to grow, embracing blockchain and adapting to these technological advancements will be crucial for businesses seeking to stay competitive in this rapidly evolving space.

To dive deeper into the future of blockchain, join us for our upcoming podcast with Zaid Munir, a visionary leader in blockchain technology. Zaid has led Scytale Labs to the forefront of blockchain solutions in Europe and North America.

Tune in on October 1st at 11 am EST, as we explore the transformative impact of blockchain, its challenges, and what lies ahead.

.jpg&w=256&q=75)

Zobaria Asma

Asst. Manager Brand & Communications

Zobaria serves as the Asst. Manager Brand & Communications at CodeNinja, driving brand strategy and communication efforts across diverse global markets, including APAC, LATAM, and MENA. With over 5 years of experience in scaling businesses, she brings expertise in SaaS branding and positioning. Her expertise spans a range of sectors, ensuring that CodeNinja's messaging resonates with diverse audiences while reinforcing its leadership in hybrid intelligence, AI-driven innovation, and digital transformation.